Trucking faces an “everything” shortage

ACT Research released its monthly Commercial Vehicle Dealer Digest, which collects data such as for-hire indices, freight, heavy- and medium-duty segments, the U.S. trailer market, used truck sales information, and a review of the U.S. macro economy.

In the release of its Commercial Vehicle Dealer Digest, ACT Research reported that the setup for the entire commercial vehicle industry remains unchanged, noting that industry capacity remains range-bound across a broad front of supply chain constraints.

The report, which combines ACT’s data analysis from a variety of industry sources, works to paint a comprehensive picture of trends impacting transportation and commercial vehicle markets.

“While the focus is on silicon and semiconductors, it is really an ‘everything’ shortage,” Kenny Vieth, ACT’s president and senior analyst, noted regarding industry constraints. “Those constraints are not localized CV industry specific challenges, but continue as pandemic-driven failures in a globally reliant web of interrelated supply chains. Rebuilding complex global networks requires the system to spin at roughly the same speed, which it is decidedly not doing at present.”

This monthly report includes a relevant but high-level forecast summary, complete with transportation insights for use by commercial vehicle dealer executives, reviewing top-level considerations such as for-hire indices, freight, heavy- and medium-duty segments, the total US trailer market, used truck sales information, and a review of the U.S. macro economy.

“Just like heightened inflation, the current situation in North American commercial vehicle manufacturing is transient: The issues impacting production will pass,” Vieth continued. “Of course, while transient implies a return to a normalized and demand driven state of activity, the word does not imply either magnitude or duration. Were this a traditional cycle, soaring market indicators and already massive backlogs would put us in the easiest part of the cycle to forecast as carrier profitability is at the heart of the vehicle demand equation.

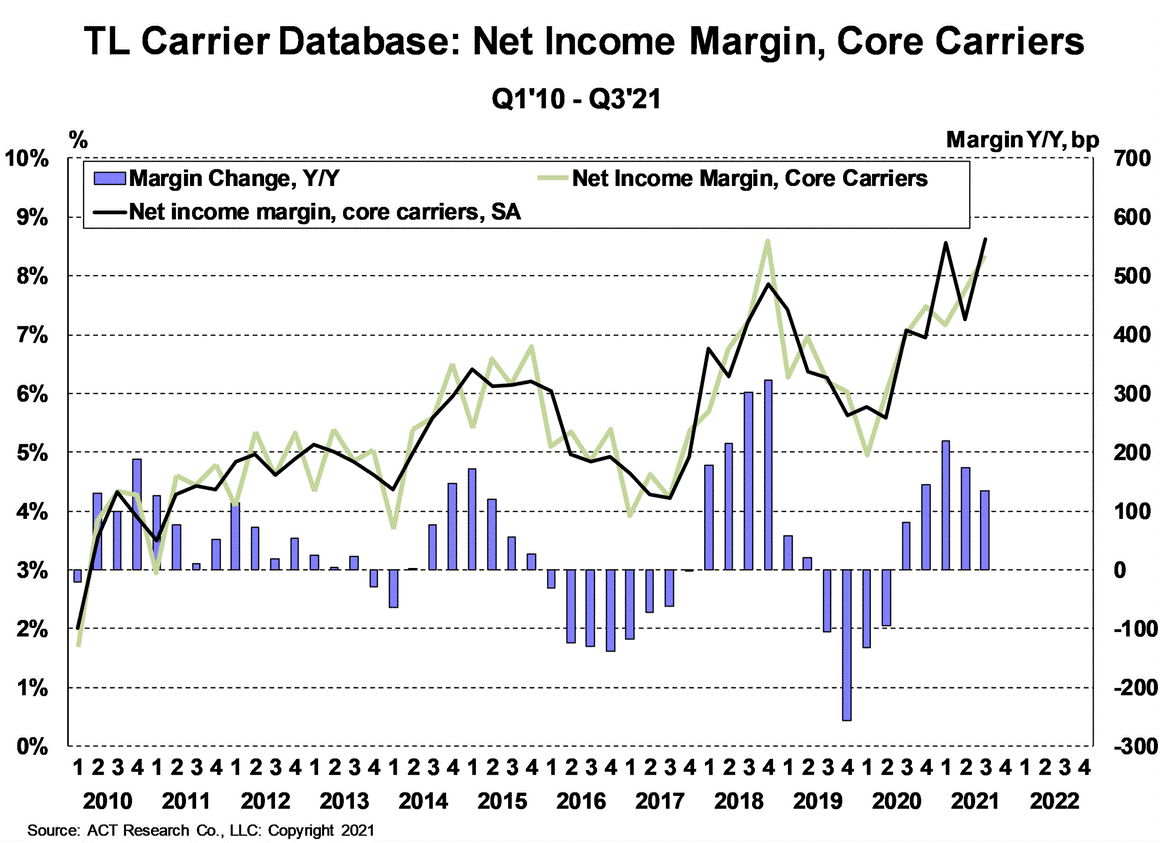

“To that end, the publicly traded TL carriers saw profitability land just short of best-ever profit margins in Q3, with seasonal adjustment boosting net profits to a record 8.6%, eclipsing the previous record set in Q1 ’21,” Vieth concluded. “Additionally, we tend not to view freight as a backlog business, but rather a real-time expression of economic activity. In this unusual period, an actual freight backlog argues for strong freight fundamentals well into 2022.”